Pushing businesses to new heights

Project completed November 2021

Project Information

Web Development

The client

Ker-Pat financial Services Ltd

The Goal

Ker-Pat financial services Ltd is a reputable financial institution specializing in providing flexible loan solutions to individuals and businesses across Jamaica working in the BPO industry. With a mission to empower their clients through financial support, KP Loans embarked on the development of a new website to enhance their online presence and better serve their customers.

KP Loans has a rich history in the financial industry, with over 10 years of experience in providing reliable and flexible loan services. They have built a strong reputation for their commitment to customer satisfaction, personalized service, and transparent loan processes. As a trusted financial partner, KP Loans understands the unique needs of their clients and aims to provide tailored loan solutions that suit their individual circumstances.

What was the goal?

The Objective

The primary objective is to establish a strong online presence for KP Loans. By developing a website, the company aims to reach a wider audience and increase their visibility in the digital space. An online presence allows potential customers to discover KP Loans and access information about their loan services conveniently.

To accomplish this our team focus on the following features:

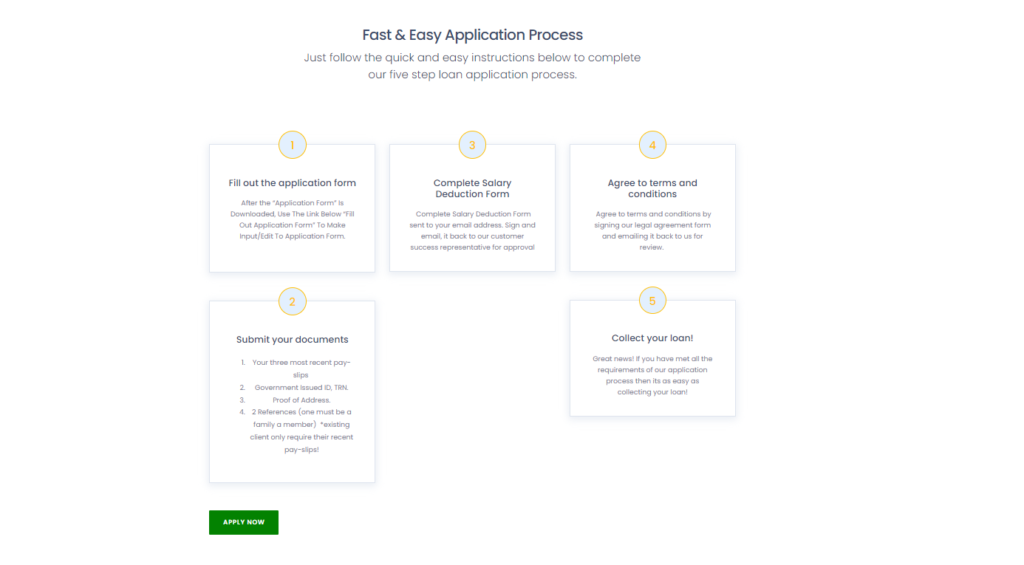

1) Online Presence: Establish a strong online presence to reach a wider audience and provide information about loan services offered by K&P Loans Jamaica.

2) User-Friendly Interface: Develop an intuitive and user-friendly website that allows visitors to easily navigate through loan options, calculate loan amounts, and submit loan applications.

3) Brand Representation: Reflect the professionalism, trustworthiness, and reliability of K&P Loans Jamaica’s brand through the website’s design and content.

4) Lead Generation: Implement lead generation strategies to attract potential customers, encourage them to inquire about loan services, and increase conversion rates.

5) Mobile Compatibility: Ensure the website is fully responsive and optimized for mobile devices, allowing users to access loan information and services on the go.

How did we get everything to work?

The Development process

Development Process:

a) Requirement Gathering: Collaborate with K&P Loans Jamaica to gather requirements, understand their target audience, and identify the desired functionalities and design preferences.

b) Wireframing and Prototyping: Create wireframes and prototypes to visualize the website’s structure, page layouts, and user interactions. Iterate with K&P Loans Jamaica to refine the design concept.

c) Front-end Development: Convert the approved design into a responsive website using HTML, CSS, and JavaScript. Ensure compatibility across different devices and screen sizes.

d) Back-end Development: Implement the necessary back-end functionalities, including the loan calculator, online loan application form, user account system, and database integration.

e) Content Integration: Collaborate with K&P Loans Jamaica to gather relevant content, such as loan information, case studies, testimonials, and FAQs. Optimize the content for web display and integrate it into the website.

f) Testing and Quality Assurance: Conduct thorough testing to ensure the website functions smoothly, has no broken links, and provides a seamless user experience. Address any issues or bugs identified during testing.

g) Deployment and Launch: Configure hosting services and deploy the website to a secure server. Coordinate with K&P Loans Jamaica for a strategic launch plan to generate initial traffic and awareness.

h) Ongoing Maintenance and Support: Provide post-launch support, including regular maintenance, security updates, and content updates, to ensure the website remains operational and up-to-date.

How did everything turn out?

Results and Achievements:

Despite the challenges, we:

a) Expanded Online Presence: The new website provides K&P Loans Jamaica with a strong online presence, allowing them to reach a wider audience and showcase their loan services.

b) Improved User Experience: The intuitive interface, loan calculator, and online loan application form enable users

Explore other Projects

The expert team at Push specializes in building innovative technology solutions for enterprises.

NCB

The National Commercial Bank (NCB) recently engaged push technologies to optimize the search engine ranking of their website. Prior to

Read moreTrident Hotel

Trident Hotels recently engaged push technologies to provide a range of IT services for their properties. Push technologies was responsible for

Read moreJoan Latty Realty

Joan Latty Realty is a successful real estate company with a growing team of agents and support staff. As the company expanded, the

Read morePush

2022 © Push Technologies